Introduction: The Strategic Imperative of Workplace Experience in a Hybrid Era

In the era of hybrid work, workplace experience has emerged as a strategic priority for corporate real estate leaders. Organizations have realized that the office is no longer just a cost center to be measured by efficiency metrics like cost per desk or utilization; it is a strategic asset that can drive performance and employee satisfaction . In fact, companies are increasingly shifting focus from traditional real estate KPIs (e.g. density or occupancy rates) toward experience-centered metrics – a trend accelerated by new employee expectations post-pandemic . A 2024 CBRE study found that employee satisfaction as a success metric has risen by 75% in importance, eclipsing old metrics like density (which fell by 67% over four years) . Forward-thinking firms see delivering a compelling workplace experience as critical to attracting and retaining talent in a tight labor market. As one industry expert put it, “Creating an ideal workplace experience is the only way to stay ahead” in a hybrid world . Indeed, over 65% of corporate real estate teams now set improving workplace experience as a significant goal, recognizing that employee engagement and well-being are directly linked to productivity and overall business performance . In summary, the strategic importance of workplace experience has never been higher: it is key to balancing employer and employee needs, supporting hybrid work models, and creating “magnetic” offices that draw people in through quality of experience .

Evolving How We Measure Workplace Experience: Qualitative and Quantitative Methods

Traditionally, real estate teams measured success with quantitative efficiency metrics – occupancy percentages, utilization rates, cost per square foot, etc. While these remain valuable, companies are evolving to include qualitative measures of employee experience. In practice, this means complementing hard data with insights from surveys, interviews, and focus groups. For example, leading organizations deploy regular employee experience surveys to gauge satisfaction, needs, and sentiment. The Leesman Index, a global benchmarking survey of workplace effectiveness, is one prominent tool: it aggregates employee feedback on how well the workplace supports their activities. Notably, the average Leesman workplace experience score improved from 64.3 (2019) to 69.5 by 2024 as companies invested in better spaces – a positive trend, though employees still rate their home office experience higher (79.5) . Focus groups and interviews provide deeper qualitative insights, uncovering why employees feel a certain way. These methods help uncover pain points (e.g. noise levels, lack of quiet rooms) that quantitative data alone might miss . In short, listening to employee voices is now seen as essential to measuring experience.

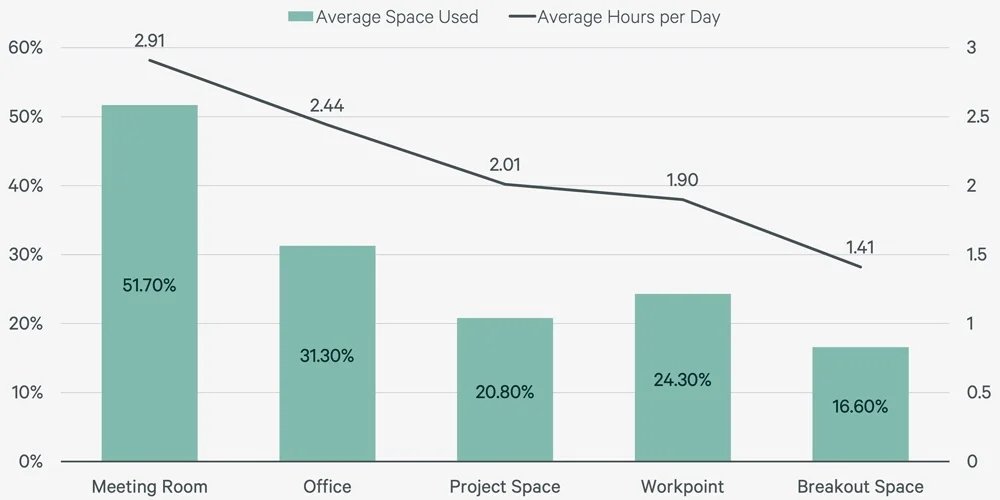

On the quantitative side, organizations are leveraging new data streams to go beyond simple occupancy counts. Sensor data and analytics allow granular tracking of how spaces are used in real time. For instance, security badge swipes (door entry logs) provide macro-level occupancy trends (used by 90% of companies to track utilization ), while IoT sensors on desks or rooms capture micro-level usage patterns and density. These tools measure not just if the office is occupied, but how it’s being used – which zones are busy, which sit empty, and for how long. CBRE distinguishes these levels: macro utilization (badge data) reveals overall space use, whereas micro utilization (sensors or network connections) shows which space types employees prefer . For example, sensor analytics from XY Sense found that collaboration spaces were utilized 64% more than individual desks in Q1 2023, reflecting employees’ heightened desire for meeting and social areas . Badge data alone wouldn’t show that nuance, but combining it with sensor data paints a fuller picture.

Graph: Example of space utilisation patterns in a hybrid office (CBRE, 2023). Collaboration areas like meeting rooms are used a greater percentage of the time (green bars, e.g. meeting rooms ~51.7% average use) and for longer durations (gray line, hours per day) compared to individual workpoints. This sensor-derived data shows employees gravitate toward collaborative spaces (meeting/project rooms) far more than individual desks, underscoring the need to measure how different spaces support new ways of working .

The combination of qualitative and quantitative methods is thus key to measuring workplace experience. Quantitative metrics (e.g. occupancy, utilization, sensor counts, environmental conditions) provide objective facts, while qualitative feedback provides context and meaning. Workplace strategists emphasize that neither is sufficient alone: “You can’t measure something that you don’t even have… bringing the qualitative side to the quantitative data points tells the full story of employee preference,” notes one workplace analytics expert . In practice, companies correlate hard data with survey results – for example, linking sensor-measured overcrowding in a space with survey comments about noise or lack of quiet areas. This holistic approach allows real estate teams to identify experience gaps and take targeted action. It’s telling that 73% of occupiers believe they have an effective workplace, but only 46% actually measure office effectiveness in a robust way . Those that do measure effectiveness tend to use a mix of metrics: space utilization rates, employee engagement scores, and even retention outcomes . The evolution in measurement is clear – from pure efficiency toward effectiveness and experience. Organizations that invest in better data (both human and sensor data) gain a significant advantage in optimising workplaces for the hybrid era.

Digital Tools and Platforms Elevating the Workplace Experience

Achieving a high-quality workplace experience at scale would be impossible without modern digital tools and platforms. Over the past few years, companies have rapidly adopted a new generation of workplace technology to measure, manage, and improve the office experience. These tools range from employee-facing mobile apps to back-end analytics platforms, often integrating with IoT sensors and AI capabilities. Below we dive into some key categories:

- Employee Experience Apps: Mobile-first platforms now serve as a “digital concierge” for office workers, merging many functions into one interface. With a few taps, employees can book desks or rooms, locate colleagues, receive company news, submit feedback, or even order amenities. For example, solutions like Appspace, HqO, and Eptura provide unified employee experience apps that connect people to their workplace. Such apps improve convenience (no more hunting for a free desk or struggling to find a meeting room) and give employees more control over their environment . They also generate valuable data – every desk booking, service request, or thumbs-up on an office event is a data point on engagement. Over the last year, vendors have heavily focused on adding collaboration features and integrations into these apps. According to Verdantix research, workplace software providers in 2023–2024 launched new app functionality aimed at employee collaboration and integration with productivity tools (like MS Teams and Outlook) . This reflects an understanding that the best experience apps seamlessly plug into how employees already work, becoming an intuitive extension of their day.

- IoT-Based Space Analytics: The physical workspace is now saturated with IoT sensors that monitor occupancy, motion, temperature, air quality, and more. These smart building sensors feed a continuous stream of data to cloud dashboards, giving real estate teams real-time visibility into how space is used. Occupancy sensors (under desks or on ceilings) detect presence and counts of people; utilization heatmaps show which zones are popular or underused throughout the day. For instance, a network of desk sensors might reveal that a particular neighborhood of workstations never exceeds 30% occupancy – indicating an opportunity to repurpose that area. Modern sensors often measure environmental conditions too. If a crowded conference room’s CO₂ and temperature levels rise, integrated building systems can automatically kick on ventilation or cooling for comfort . This not only enhances experience (maintaining comfort and wellness) but supports ESG goals by optimizing energy use when and where needed. The proliferation of affordable, wireless sensors means even older offices can be retrofitted for data collection. Importantly, the data is now more actionable: cloud analytics platforms apply AI/ML algorithms to detect patterns and anomalies. As one report notes, advanced space management systems with AI can forecast future space needs based on historical data, and even provide personalized workspace settings (lighting or temperature adjusted to an individual’s preference when they check in) . These capabilities were futuristic a few years ago; today they are increasingly common.

- Hybrid Work Dashboards & Utilization Analytics: To manage hybrid attendance, organizations are deploying visual dashboards that compile data from badging systems, reservation apps, and sensors. These dashboards – often part of an Integrated Workplace Management System (IWMS) or specialized occupancy analytics tool – allow CRE teams to monitor daily attendance, peak vs. average occupancy, space utilization by type, and even predictive models. For example, a hybrid attendance dashboard might show the live occupancy of each office location, compare it to historical baselines, and highlight which days are consistently underutilized. This informs both tactical decisions (e.g. consolidating floors on slow days) and strategic planning (e.g. identifying space to sublease). According to JLL’s latest benchmarking, badge swipe data remains the predominant method (used by 90% of organizations) to track utilization, but many firms now augment it with reservation system data (49%) and even passive visual monitoring (41%) to get a more complete picture . The adoption of desk booking systems has especially boomed: by 2025, 46% of companies report using a space-reservation system, more than double the share from a year prior . These tools have become “critical to enhancing the hybrid work experience by providing transparency and predictability for when and where employees will be in the office,” enabling better coordination in hybrid teams . The data from such systems also feeds utilization analytics, helping identify trends like “Tuesdays are the new peak day” or “the 4th floor is consistently half-empty on Fridays.” With robust dashboards, CRE leaders can move from reactive management to data-driven strategy, continually tuning the workplace to actual usage patterns.

- AI-Enhanced Analytics and Automation: Artificial intelligence is the newest frontier in workplace management tools. While still emerging, AI is being used to augment human decision-making by finding patterns and optimizing scenarios that would be hard for people to see. A majority of corporate real estate leaders anticipate “Hybrid work 2.0” where AI supports their teams within the next five years . Already, about 90% of large firms plan to integrate AI into CRE processes (like occupancy planning, lease admin, workplace strategy) in some form . Current AI applications include predictive analytics (e.g. forecasting how a 10% increase in headcount will impact space needs or predicting which departments are likely to come in on the same days), scenario modeling (evaluating different seating or scheduling policies for impact on utilization and employee networks), and natural language processing (analyzing open-ended feedback from employees at scale to detect sentiment or common requests). For instance, JLL’s analytics teams use machine learning models to identify patterns in millions of data points, allowing them to advise clients on how to re-stack offices or adjust cleaning schedules based on predicted usage. In practice, the AI adoption in CRE is still nascent – an industry survey noted that although 90% use software systems for space and occupancy data, less than half currently use AI in those processes . Many organizations are in pilot stages with AI, working through challenges of data quality and integration . However, the direction is clear. From chatbot assistants that let employees ask “Where’s a free meeting room right now?” to generative AI that can summarize monthly workplace reports, these technologies promise to make both the user experience and management of space more intelligent. Early movers are already seeing benefits: firms with advanced data analytics (precursors to AI) gain significant advantages in identifying usage patterns and optimizing space allocations . As AI capabilities mature, we can expect increasingly proactive workplaces – offices that adjust and improve themselves through self-learning systems (for example, lighting systems that learn occupancy patterns and adjust in anticipation, or climate controls that personalize to individuals). CRE leaders should approach these tools with a strategic plan, focusing on meaningful use-cases and ensuring the insights translate to action on the ground.

In summary, digital platforms are the backbone of measuring and improving workplace experience today. From the employee’s perspective, these technologies reduce friction (easy booking, seamless access, personalized comfort) and increase engagement (feeling connected to the workplace community even on hybrid schedules). From the real estate team’s perspective, they deliver a wealth of data and automation opportunities to manage space efficiently and effectively. It’s telling that 78% of organizations now use some form of occupancy planning or workplace management software service to maintain their space data . Moreover, the marketplace for these solutions is rich – an independent 2024 buyer’s guide analyzed 21 major workplace management platforms, noting trends like AI, machine learning, and advanced analytics being built into offerings across the board . The tools are available; the differentiator will be how companies deploy them to create actionable insights and better employee experiences.

Benchmarking Frameworks and Certifications: WELL, Leesman, Gensler WPI, Verdantix

To guide their journey toward a high-performance workplace, many organizations are turning to external frameworks and benchmarking tools. These provide structured methods to measure workplace experience and compare against industry standards or best practices. Four notable frameworks are WELL, Leesman Index, Gensler’s Workplace Performance Index (WPI), and Verdantix assessments:

- WELL Certification (IWBI): The WELL Building Standard, developed by the International WELL Building Institute, is a leading framework for designing and measuring healthy, wellness-oriented workplaces. It focuses on ten concepts – Air, Water, Nourishment, Light, Movement, Thermal Comfort, Sound, Materials, Mind, Community – that collectively impact employee health and well-being . Achieving WELL Certification means a workplace has met rigorous criteria (through audits and measurements) for features like air quality, lighting quality, biophilic design, fitness opportunities, comfort, and mental health support. The significance for workplace experience is profound: peer-reviewed research has found that WELL-certified offices see dramatic improvements in employee experience metrics. A recent study of multiple North American offices that achieved WELL Certification showed overall workplace satisfaction jumped from 42% pre-certification to 70% post-certification, a nearly 30-point increase . Employees in WELL spaces also reported significantly higher perceived well-being (+26%), mental health (+10%), and even a self-reported productivity boost (+10 points in productivity scores) . These are powerful validations that “better buildings make for better experiences.” For corporate real estate heads, pursuing WELL (or incorporating its principles) provides a clear roadmap to elevate the human experience in the office – from improved air and lighting (which reduce fatigue and illness) to policy changes like providing healthy food and encouraging movement. Additionally, WELL offers an ongoing benchmarking opportunity: organizations can continuously measure factors like air quality or occupant comfort and see how they stack up to WELL standards or where they can improve. The popularity of WELL has grown worldwide, including in the UK and Europe, as companies seek to demonstrate commitment to employee wellness as part of their ESG goals. Some firms also pursue dual certification (WELL + LEED) to cover both wellness and sustainability, an approach made easier by a 2023 partnership between IWBI and the Green Building Council . In summary, WELL is both a measurement framework (with defined metrics for environmental and health factors) and a signal of quality that can help attract employees back by assuring them their workplace is holistically designed for their well-being.

- Leesman Index: Leesman is a global benchmarking service specializing in measuring employee workplace experience through surveys. It produces the Leesman Index (Lmi) score, which is essentially an employee satisfaction and effectiveness rating for a workplace, on a scale up to 100. Companies can survey their employees via Leesman’s standardized questionnaire, which evaluates how well the workplace supports various activities (from individual work to collaboration, learning, socializing, etc.) and how satisfied employees are with a range of workplace features (e.g. noise levels, amenities, furniture comfort). The power of Leesman is in its benchmarks: with a database of thousands of workplaces worldwide, a company can see how its Lmi compares to the global average or top performers. As noted, the global average Lmi was around 64 pre-pandemic and has risen to ~69.5 by 2024 , indicating overall improvements as offices adapt, but also showing many workplaces still have room to grow. Leesman’s research provides rich insights – for example, they highlight gaps between leadership perceptions and employee needs. In a 2025 analysis, 70% of organizations said the primary purpose of their office is to “foster collaboration and knowledge exchange,” and 43% said “to promote employee connection and pride” . Yet employees still rate “individual focused work” as their most important activity (89% say it’s important) , and often their ability to do that at the office is lacking (only 35% satisfied with noise levels, for instance ). Such findings underscore the need to balance collaborative buzz with quiet space – a nuance that Leesman data brings to light. For CRE leaders in the UK and Europe especially, Leesman has become a de facto standard to measure the success of workplace strategies. Many organizations conduct a Leesman survey before and after a major workplace change (e.g. a redesign or move to hybrid) to quantify the impact on employee experience. A high Leesman score can be used in internal KPIs or even publicly as a bragging point (some firms aim to join the “Leesman+” category – the top 10% of workplaces globally). In summary, the Leesman Index provides a robust qualitative KPI for workplace experience, allowing leaders to track improvements over time and benchmark against peers on a like-for-like basis.

- Gensler Workplace Performance Index (WPI): Architecture and design firm Gensler has long researched the link between workplace design and business outcomes. Their Workplace Performance Index® (WPI) is a proprietary survey-based tool that measures both workplace effectiveness and the experience of the space. Notably, Gensler distinguishes between space effectiveness (how well the space enables work) and workplace experience (how the space makes employees feel, its look-and-feel and ambiance) . The WPI generates a composite effectiveness score based on 30+ variables (covering functionality, support for different work modes, etc.), and an experience score based on 8 variables (focusing on the quality of the physical environment) . By surveying employees across these dimensions, Gensler can plot how a workplace performs and, importantly, correlate those scores with business metrics. Their research consistently shows that high-performing workplaces (high WPI and experience scores) correlate with higher levels of employee engagement, innovation, and commitment . In one global survey comparison, Gensler found that 43% of workplaces achieved both high effectiveness and great experience – and employees in those spaces reported the strongest engagement and innovative behavior . On the flip side, about one-third of workplaces scored poorly on both effectiveness and experience, and these had the lowest levels of employee engagement and innovation . This kind of analysis underscores that space and experience are not mere “soft” metrics – they are tied to hard outcomes like productivity and creativity. The WPI framework helps companies identify specific design attributes to improve. For example, Gensler’s surveys often reveal which space types or amenities employees wish they had more of (or less of), guiding design adjustments. It also measures choice and autonomy – whether employees have a variety of settings and the choice of where to work – which Gensler links to a better experience. Companies in North America, and increasingly Europe, leverage WPI as both a diagnostic tool (pre- and post-occupancy evaluations) and a benchmark (Gensler has a large dataset to compare by industry or region). The advantage of WPI is the integration of design metrics with experience outcomes – it speaks the language of architects (space programming, square footage allocations, etc.) and the language of HR (engagement, satisfaction) simultaneously. In practice, a CRE leader might use WPI results to justify investments in certain design changes (e.g. “Our WPI shows focus rooms are lacking, which drags down effectiveness; adding them should boost perceived productivity”). Like Leesman, it provides an external validation and reference point – e.g., knowing that your workplace effectiveness is in the top quartile can be a powerful story to tell leadership or prospective hires.

- Verdantix Workplace Tool Assessments: Verdantix is an independent research and advisory firm that evaluates smart building and workplace technologies. While not a “certification” like WELL or a satisfaction benchmark like Leesman, Verdantix’s reports act as a framework for benchmarking the tools and systems that underpin workplace experience. Their Green Quadrant reports compare leading vendors in categories like IWMS (Integrated Workplace Management Systems) or smart office platforms, scoring them on functionality and strategy . For example, Verdantix’s 2023 Green Quadrant on Workplace Systems Integrators evaluated 12 major integrators, helping firms identify which partners are strongest in deploying new tech . More directly relevant, Verdantix publishes Buyers’ Guides and Tech Roadmaps for space and workplace management solutions (e.g. the 2024 Space & Workplace Management Solutions Buyer’s Guide ). These reports identify key trends (like the focus on employee collaboration features and the incorporation of AI in space management software ) and profile the capabilities of various tools (from reservation apps to occupancy analytics to environmental sensors). For a head of corporate real estate, keeping abreast of Verdantix findings is a way to benchmark one’s technology stack and innovation maturity against the market. Verdantix also often outlines a maturity model for data usage: as noted earlier, many organizations have lots of data but few have reached the highest maturity in using it for advanced analytics . Their research found that while 77% of firms report some level of technology maturity in workplace data, “none have achieved the highest level” yet – signaling growth potential. Verdantix frameworks can thus help CRE leaders gauge where they stand on the journey from basic data collection to predictive, AI-driven insight. Additionally, Verdantix highlights emerging areas like ergonomics software, employee comfort apps, or even workplace carbon tracking (some workplace platforms now even track the carbon footprint of office utilization ). In short, Verdantix serves as a compass for workplace tech – ensuring that when measuring and improving experience, companies are aware of the latest tools and how to make the best buying decisions.

In practice, many organizations will use multiple frameworks in tandem. For example, a new HQ project might aim for WELL Certification (to ensure a healthy environment), use Leesman surveys to measure employee sentiment before and after move-in, and leverage a WPI analysis to fine-tune the design for productivity. At the same time, the CRE team might consult Verdantix reports to choose an IWMS platform that can capture the needed data during operation. These frameworks are not one-size-fits-all checklists, but they provide structured methods and credibility. They also allow companies in the UK, EU, and North America alike to speak a common language about workplace experience – whether it’s a WELL plaque on the lobby wall, a Leesman score in the annual report, or a tech roadmap derived from Verdantix, these are recognizably authoritative measures that signal an organization’s commitment to employee experience.

From Metrics to Meaning: Linking Workplace Experience to Business Outcomes

Ultimately, measuring workplace experience is not an academic exercise – it’s about driving real business outcomes. By evolving metrics from purely cost or efficiency-based toward experience-based, companies aim to directly influence factors like productivity, collaboration, talent retention, employee engagement, and even ESG and DEI goals. This section explores how workplace experience metrics connect to tangible outcomes and why that matters to executives.

Productivity: One of the strongest links is between a quality workplace and employee productivity. When employees have the right spaces to do their best work – be it quiet zones for focus or collaborative hubs for team brainstorms – their output improves. Conversely, a poorly designed or uncomfortable office can hinder productivity (think of time lost searching for a meeting room or being distracted by noise). There are now data to back this intuition. Cushman & Wakefield’s ongoing Experience Per Square Foot™ (XSF) research, which surveys tens of thousands of employees, introduced a Productivity Index composed of factors like the ability to focus, team effectiveness, and “best work” environment. Alarmingly, they found that employee productivity scores fell by 13 percentage points in 2023 compared to 2022 – a drop they correlate with declining workplace experience drivers . The top five drivers of productivity identified were Inspiration, Energy, Learning, Belonging, and Cultural Connection – all aspects deeply influenced by the work environment and culture. In 2023, fewer than 50% of employees reported a positive experience in four of those five areas (all except Learning) . This suggests that the post-pandemic office, for many, was failing to inspire, energize, include, or connect people – and productivity suffered as a result. The silver lining is that these drivers are precisely what workplace experience initiatives can improve. By measuring things like “do employees feel a sense of belonging in the office?” or “does the space energize people?”, and then acting on that data (e.g. creating more community-building events, improving décor and vibe, reinforcing company culture on-site), firms can tangibly boost productivity. The WELL Building study mentioned earlier also underscores this: those WELL-certified offices saw a measurable uptick in self-rated productivity alongside big jumps in satisfaction . Productivity is often thought of in terms of output per worker, and while many factors influence it, workplace conditions are a major lever. That’s why progressive companies no longer see amenities or design as fluff – they see them as productivity infrastructure. For example, when Microsoft redesigned parts of their campus, they measured outcomes like time to complete certain tasks or frequency of innovative ideas, linking improvements to new collaborative spaces and better ergonomics. Similarly, financial firms have noted that bringing teams together in high-quality war rooms for critical projects can accelerate decision-making versus remote. In essence, by measuring the right experience factors, companies gain insight into how to tweak the environment to get the best from their talent – more focused work, faster learning, and creative serendipity.

Collaboration & Innovation: The office’s unique value proposition in a hybrid world is often as a collaboration hub – the place people come together to spark ideas and build relationships. Experience metrics that track collaboration (for example, frequency of cross-team interactions, usage of collaboration spaces, or employee surveys on whether the office supports knowledge sharing) are being tied to outcomes like innovation and problem-solving quality. The Leesman data revealed that the number one reason corporate leaders maintain an office is **to foster collaboration and knowledge exchange (cited by 70% of organizations) . Employees seem to affirm this need: in Leesman’s surveys, 73% agree their office environment supports them in sharing ideas and knowledge with colleagues . That’s a positive sign that a well-designed office can facilitate the kind of informal, spontaneous conversations that lead to innovation. We see the outcomes in industries like tech, where companies monitor patent rates or product development cycle times in relation to workplace changes. A case in point: when a major automaker created a new innovation center with a variety of collaborative lounges and project labs, they tracked a rise in the number of new product ideas entering their pipeline, correlating it with increased employee collisions (a metric for unplanned encounters) in those spaces. Collaboration metrics (like how many meetings happen in person vs. virtual, or network analysis of inter-department contacts) thus feed into strategic decisions – e.g., if collaboration is lagging, maybe the space needs reconfiguring or policies need adjusting to bring teams together more frequently. An important related outcome is knowledge retention and mentoring: companies worry that without in-person interaction, tacit knowledge and culture don’t transmit to newer employees. Measuring experience elements like “opportunities to learn from others” or “sense of community” ties directly to that concern. Offices that score high on community and mentorship likely help retain organizational knowledge better, which in the long run fuels innovation and continuity.

Talent Attraction & Retention: The quality of workplace experience has become a differentiator in the war for talent. In a world where employees can often choose to work remotely or have their pick of employers, a great workplace can tilt a candidate’s or employee’s decision. Companies are now explicitly connecting their workplace experience metrics to retention and recruitment outcomes. For example, some track employee turnover in relation to satisfaction with the office: one tech company noticed that teams with low engagement in their office (as measured by low attendance and poor feedback on the space) had higher attrition, so they invested in those teams’ neighborhoods – adding social areas and updating decor – and subsequently saw retention improve. JLL’s research emphasizes creating “magnetic workplaces that attract employees through experience-rich environments” . The rationale is simple: if people genuinely enjoy coming to the office – because it’s vibrant, social, and helps them work better – they are more likely to stay with the company (and come into the office regularly). Metrics like employee Net Promoter Score (eNPS) for the workplace or the aforementioned Leesman scores can serve as leading indicators of retention risk. For instance, if your workplace experience rating plummets, it could foretell morale issues that eventually lead to resignations. On the recruiting side, companies are now showcasing their offices (sometimes literally, via virtual tours) as part of their employer brand. A high-profile example is Salesforce, which touts its Ohana Floor spaces and wellness zones in recruiting materials, effectively saying “we invest in our people’s experience.” Some firms measure the acceptance rate of job offers or the time to fill positions at different locations, correlating those with the appeal of the office or even whether candidates mention the office as a factor. The new generation of employees (Gen Z) places high value on social connection, modern amenities, and alignment with values – the office can embody those. A case study in London saw a major pharma company open a state-of-the-art HQ with hospitality-style services and community events, and they achieved a 95% employee satisfaction (NPS) with the workplace along with improved retention of key talent . Clearly, by measuring satisfaction and usage and iterating the office accordingly, companies can positively impact retention and make their firm a destination for top talent.

Engagement & Culture: Employee engagement – the emotional commitment and discretionary effort of employees – is heavily influenced by the work environment. Gallup and other research bodies have long included “having the right materials and equipment” or “sense of connection at work” in engagement drivers. The physical workplace underpins those. If we measure engagement via surveys or indices, we often find direct ties to workplace experience metrics. Gensler’s data, for example, showed that employees in effective, experience-rich workplaces had much higher engagement and commitment to their organization . Conversely, in poor environments, engagement suffers. One specific aspect is culture and belonging. Hybrid and remote work made many feel disconnected; the office, when done right, serves as the physical manifestation of company culture – through design, branding, and social rituals. Metrics such as “I feel connected to my company’s culture” or “the workplace gives me a sense of pride in my organization” are now commonly included in experience surveys . Leesman’s poll of CRE leaders noted that promoting connection and pride was a top reason for offices (43% said so) . If an experience measurement finds that, say, only 50% of employees feel proud of or connected to their workplace, that’s a red flag that culture isn’t permeating. This can prompt interventions like redesigning the space to reflect company values (e.g. showcasing company mission and successes on walls, creating communal spaces for town halls), or programming more team events on-site. During 2023–2024, many firms ramped up office-based events (happy hours, hackathons, celebration of cultural days, etc.) specifically to boost engagement and rebuild social capital. These efforts are tracked: some companies count attendance at office events, frequency of cross-team lunches, or simple presence in the office as engagement proxies. The idea is not to force a return, but to monitor whether people want to be there. An illuminating example: at Sodexo’s new London HQ, they instituted a community manager program that organized regular events and concierge services, resulting in a 90% employee satisfaction score for the workplace and visibly higher on-site engagement . The high satisfaction indicates that employees feel more engaged and happier at work, which likely translates to better service and productivity in their roles. In essence, by measuring and enhancing workplace engagement, companies reinforce a positive feedback loop: engaged employees contribute more and strengthen the company culture, which in turn makes the workplace more appealing.

ESG and DEI Performance: Workplace experience efforts increasingly align with broader Environmental, Social, and Governance (ESG) and Diversity, Equity, and Inclusion (DEI) goals. Real estate leaders are recognizing that how you manage physical space can advance sustainability and inclusion objectives – and they are measuring this connection. On the environmental (E) front, optimizing office use through experience metrics leads to smaller, more efficient footprints and reduction in waste. For example, by measuring actual utilization and embracing hybrid work, many companies found they could “right-size” their portfolios, saving costs and also cutting carbon emissions from energy use in underutilized space. A JLL survey noted that 74% of organizations have active sustainability programs linked with occupancy planning – such as initiatives to reduce space (and thus energy consumption), cut waste, and reuse furniture . Metrics here include energy per employee, space per employee (in EMEA, space per seat has actually increased 14% over 4 years as density pressures ease, improving comfort but also requiring balancing with energy use), and targets for people-per-desk ratios to minimize unused seats. By measuring and reporting these, CRE can contribute to ESG reporting. Additionally, technology like sensors contribute to environmental goals by fine-tuning HVAC and lighting – companies measure indoor environmental quality (IEQ) and energy usage in real time as part of both experience (comfort) and sustainability. For the social (S) and DEI aspects, a thoughtful workplace experience strategy ensures the office is inclusive and welcoming to all employee groups. This includes providing spaces that accommodate diverse needs – mothers’ rooms for nursing parents, prayer/meditation spaces for faith needs, gender-neutral restrooms, accessible design for those with disabilities, etc. We see this in practice: JLL’s research found many organizations expanding health and cultural spaces (mother’s rooms, prayer rooms, wellness centers) as they refine workplaces . The presence and use of these spaces can be tracked (e.g. how often the wellness room is booked, or feedback from employee resource groups on the space). Companies also measure inclusive experience through surveys – for example, asking if “I feel comfortable being myself in the workplace” or segmenting satisfaction data by demographic groups to ensure no group is having a systematically worse experience. If, say, women in a company report lower satisfaction with safety or privacy in the office, that’s a DEI issue that needs addressing (perhaps through design changes like better lighting in parking areas or more enclosed spaces). Moreover, hybrid work policies themselves tie to DEI and talent inclusion – measuring who is coming in versus who isn’t can reveal if certain groups are excluded from on-site opportunities. For instance, if junior staff or certain minority groups come in less because they feel less welcome or have longer commutes, the company might intervene to create programs or incentives to even the playing field. The governance (G) angle is more indirect, but having robust data and transparent metrics on workplace experience contributes to good governance by enabling data-driven decisions and demonstrating accountability to stakeholders (investors, employees, regulators) about how the company treats its people. In summary, by broadening the lens of workplace metrics to include environmental efficiency and social inclusion, companies can hit two targets with one arrow: improve day-to-day experience while also bolstering their ESG/DEI performance indicators. A well-run workplace experience program thus not only pleases employees – it becomes part of the company’s narrative on sustainability and social responsibility.

Regional Perspectives and Best Practices (2023–2025): UK, Europe, and North America

Workplace experience is a global priority, but its implementation and evolution have regional flavors. Here we highlight trends and best practices observed in the UK and Europe versus North America, along with mini case studies from 2023–2025:

United Kingdom & Europe: In the UK and broader Europe, companies have been balancing efficiency drives with a renewed emphasis on experience and quality. The pandemic’s aftermath and economic pressures (especially in parts of Europe facing high energy costs or slower growth) led many EMEA firms to downsize real estate for cost savings, but they are simultaneously investing in targeted workplace experience enhancements for remaining space . A clear trend in Europe has been a flight to quality: as portfolios shrink, companies are upgrading key hubs to higher standards (prime locations, sustainable and wellness-certified buildings) to entice employees back. According to CBRE’s regional analysis, **European offices have been redesigned with more space per person (+14% space per seat in 4 years) and a huge increase in collaborative and amenity spaces (+54% amenity space since 2021) . This marks a reversal of the old densification trend and reflects an emphasis on in-person interaction and social appeal. For example, many London firms are implementing hospitality-inspired services – concierge desks, on-site barista cafes, rooftop gardens – to provide a five-star experience that employees can’t get at home. One best practice case comes from a London headquarters of a major pharmaceutical company, which opened in 2023 with a purpose-built design focused on employee experience. They partnered with workplace hospitality providers to run community events, convenient services (like on-site dry cleaning and food delivery coordination), and personalized welcomes for staff. The result was a remarkable 95% workplace NPS (net promoter score), indicating employees were highly likely to recommend their new office to others . Similarly, Sodexo’s UK HQ introduced a community manager role to curate in-office experiences (from Pride celebrations to wellness talks), achieving a 90% employee satisfaction score for on-site experience. These examples show how European companies are creatively enriching the office with programming and amenities, not just physical changes.

Another characteristic in Europe is the influence of formal standards and regulations. European employers are attuned to EU and country-specific guidelines on wellness, ergonomics, and environmental performance. Many UK firms, for instance, follow the British Council for Offices (BCO) guidance, which has increasingly stressed wellness and comfort in its specifications. WELL Certification has gained significant traction in Europe as a way to validate healthy workplaces – cities like London, Paris, and Berlin now boast a growing number of WELL-certified or WELL-registered offices, something practically unheard of pre-2020. Moreover, Europe’s strong sustainability ethos means Green Building certifications (LEED, BREEAM) overlapping with experience – for example, a highly sustainable building often provides better air quality, daylight, and thermal comfort, all experience boosters. Some European companies explicitly tie workplace experience to employee value proposition in the context of flexible work: they emphasize that when employees do come in, it’s worth it. For instance, a Dutch finance company implemented “office experience days” – designated days where extra efforts (guest speakers, free lunches, team-building activities) are provided to make the in-office day special and valuable. Early results showed higher attendance on those days and improved employee mood and cohesion afterward (as measured by pulse surveys).

It’s not all rosy, of course – European firms also face the challenge of encouraging people back to offices when many prefer remote. The carrot of a great experience is often preferred over the stick of mandates in the UK/EU context, given works councils and cultural expectations. We see many European employers opting for incentives and engagement (cool office design, social events, subsidized commuting) rather than strict mandates. Those who are measuring outcomes have found that structured hybrid policies combined with a compelling office experience yield the best results: in France, for example, one company reported that after implementing a 3-day in-office guideline with a revamped office including more collaboration zones and quiet pods, they saw office attendance stabilize at ~60% utilization (higher than the prior 40%) and an uptick in self-reported employee engagement. Comparatively, companies that only mandated returns without improving the experience saw more pushback and only marginal gains in presence.

North America (US & Canada): In North America, the conversation has also evolved from cost-cutting to portfolio optimization and experience in the last couple of years. According to JLL’s 2025 Occupancy Planning report, 73% of CRE leaders in the Americas now prioritize strategic portfolio optimization over pure cost reduction . This means using data to decide which spaces to keep or shed, and crucially, how to make the kept spaces more effective. Many large U.S. employers have tightened hybrid work policies (more mandated days in office) but realize that mandate alone isn’t enough – they must earn the commute. So, North American best practices include significant investments in custom amenities and workplace services. A trend in major U.S. cities is companies partnering with flexible space or hospitality providers to offer “hotel-grade” experiences in their offices – from high-end coffee bars and lounges to wellness centers and curated events. Tech companies in Silicon Valley were famous for this pre-pandemic (free meals, gyms, etc.), but now even financial and professional services firms are adding similar perks to make the office a magnet.

Data plays a huge role in NA best practices: American companies have been early adopters of sensor tech and analytics to continually tune their workplaces. It’s common for a U.S. corporate HQ to have a dedicated command center dashboard monitoring everything from occupancy to air quality to employee feedback in real time. Those that excel use this data proactively. For example, one New York media company noted through sensor data that their mid-week peak was causing overcrowding in certain collaboration areas. They responded by introducing a “peak day” pop-up concept, bringing in extra mobile furniture and even food trucks on Wednesdays to accommodate and delight the surge of employees – an idea that was well-received and smoothed out some pain points (they measured higher satisfaction on peak days post-implementation). North American firms also experiment a lot with pilot spaces – creating mock-up zones with different designs or tech (say, a VR collaboration cave or a quiet “library” room) and then measuring usage and feedback. This test-and-learn approach, supported by rich data, leads to more agile improvements.

In terms of outcomes, U.S. companies are very focused on productivity and innovation metrics. Many have linked their workplace changes to KPIs like revenue per employee, project cycle times, or patent filings. While multiple factors influence those, workplaces are considered part of the equation. A notable example: IBM, in its redesign of offices for agile teams, tracked the increase in software release frequency and tied some of that success to the co-location and space design that fostered better scrum teamwork. Also, with the tight labor market in tech and professional fields in 2021–2022, some American companies that initially declared “remote-first” have pivoted to “office-centric hybrid” because they saw culture and training gaps. But to bring people back voluntarily, they heavily marketed the new experience – e.g., Google famously invested in outdoor workspaces, wellness amenities, and even a private campus park to offer an attractive environment. These efforts are measured via internal surveys (Google’s annual “Googlegeist” survey includes questions on workplace satisfaction) and even badge data to see if attendance correlates with site improvements.

North America has also seen the rise of certification and rating usage as a best practice. WELL and LEED are big in the U.S., and many Fortune 500 companies now aim for those in their main offices – partly for the substantive benefits and partly for the PR and employee pride aspect (“I work in a WELL Platinum office”). Another framework unique to the U.S. is Cushman & Wakefield’s XSF (Experience per Square Foot), which several companies use to benchmark themselves. C&W’s XSF has surveyed over 100,000 employees globally, giving companies a wealth of comparison data. For instance, C&W can tell a client how their “sense of belonging” score or “manager support” score in the workplace compares to industry peers. American companies are quite metrics-driven in that sense, and leadership often wants that distilled into a simple index or ranking. The XSF data from 2023 showed that as more companies pushed return-to-office, there was a widening gap between those who managed it well versus poorly – the top quartile of offices in XSF had significantly higher employee engagement and productivity, while the bottom quartile saw declines, correlating strongly with whether those offices had thoughtfully improved the experience or not . The lesson: measuring and acting on experience is a competitive differentiator.

Cross-Regional Learnings: While UK/Europe and North America have differences, there are shared best practices that transcend geography by 2025. One is the notion of the “balanced scorecard” for workplace – leading organizations everywhere now measure a mix of utilization (efficiency) and experience (effectiveness) metrics. They report up to executives not just space costs, but also things like employee satisfaction, collaboration metrics, and impact on talent. Another shared approach is inclusive design: whether it’s a New York bank or a Stockholm tech firm, there’s growing emphasis on making offices accessible and welcoming to all. We see prayer rooms in Texas and in London alike; we see mother’s rooms in Paris and Toronto; and we see neurodiversity considerations (quiet zones, calming rooms) becoming more common too. The drivers may differ (regulatory in some European cases, or risk management in the U.S.), but the outcome is the same: a richer, more human-centric workplace. Regionally, cultural nuances matter in how experience is executed – e.g., Europeans might emphasize natural light and design aesthetics influenced by local culture, whereas Americans might focus on convenience and scale of amenities – but all aim for the core outcomes of a happier, more engaged workforce in the office.

Finally, case studies in 2023–2025 show that those who invested in measuring and improving experience are reaping rewards. To illustrate: a global professional services firm compared its offices and found those that scored highest in their internal experience index had 20% higher voluntary retention of staff and even 10% higher client satisfaction scores, because engaged employees likely provided better service. In contrast, offices that were allowed to stagnate (no upgrades, no feedback loops) saw diminishing attendance and had to resort to mandates to get people in – which is not a sustainable long-term strategy. The head of CRE at a major UK bank summed it up: “We’ve shifted from managing property to managing experiences. The data and tools now let us do that with precision. If you get it right, the business outcomes – productivity, innovation, retention – follow.”

In conclusion, across the UK, Europe, and North America, the journey from traditional real estate metrics to advanced, experience-centered KPIs is well underway. The leading organizations treat workplace experience as a strategic program: they measure it rigorously, using both new tech and human feedback, they benchmark and learn from the best, and they continually iterate their workplaces as a driver of business success. The era of hybrid work has only underscored this need – when people have a choice of where to work, the office must earn its place by delivering value and positive experience. By focusing on the methods and tools discussed – from qualitative surveys to IoT analytics, from WELL certifications to AI-driven insights – corporate real estate leaders can elevate their workplaces from mere spaces to competitive advantages. An engaging, data-informed workplace not only optimizes real estate efficiency, it unlocks effectiveness: fostering a productive, collaborative, and inclusive environment where employees genuinely want to be. That is the new benchmark of success in the evolving world of work.

Sources:

- CBRE 2024–2025 Global Workplace & Occupancy Insights

- JLL Occupancy Planning Benchmark 2025 (Press Release)

- Facilities Dive – CBRE tech survey summary (2025)

- Leesman Index – “The workplace why” (2025)

- Gensler Global Workplace Survey Comparison (2023)

- Harvard Business Review – Appspace Workplace Experience (2023)

- Avuity/CBRE – Workplace Effectiveness Metrics (2024)

- Cushman & Wakefield XSF Insights (2024–2025)

- IMEG / Journal of Building & Environment – WELL study (2025)

- Circles (Sodexo UK HQ case study) (2023) and Circles (Pharma HQ case)

- Additional data from Gartner, McKinsey, and Verdantix via secondary sources as cited above.